If you own a home in Wisconsin, it’s crucial to ensure your property is sufficiently protected. Homeowners insurance, which provides security against unforeseen damage, is among the most crucial forms of this protection. The roof is one of your home’s many external barriers to the elements, but what happens after 20 years?

To answer the question, this blog post explores the complexities of insurance coverage for a 20-year-old roof in Wisconsin, looking at the variables that affect coverage while offering homeowners practical advice.

Does Insurance Cover A 20-Year-Old Roof?

You should carefully review your homeowner’s insurance policy to find out if it will cover a roof that is 20 years old. Most standard policies pay for damage caused by certain hazards, such as hail, wind, fire, and falling trees. However, age and wear and tear are typically not covered.

Insurance companies frequently base a payout decision on how old your roof is. Many insurers believe that a roof that is 20 years old or older has outlived its useful life, though some policies differ. They might not pay for a replacement in full at this point, or they might altogether reject coverage.

Why Does Insurance Avoid Covering An Old Roof?

While it may seem unfair, here are some of the reasons why an insurance company may deny your claim:

1. Age of the Roof

Most insurance policies limit the age of the roof they will cover, typically around 20 years. Once a roof exceeds this age, insurance providers consider it too old and at a higher risk of failure, making it ineligible for coverage under the policy.

2. Wear and Tear

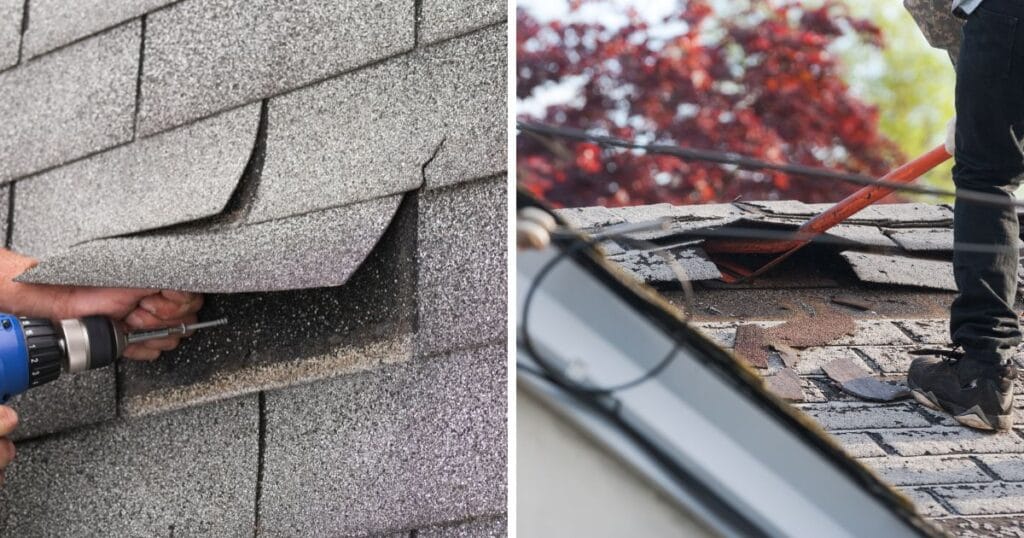

Over time, roofs experience natural wear and tear from exposure to weather elements like sun, wind, rain, and snow. Insurance companies consider this gradual deterioration a maintenance issue, and they expect homeowners to take responsibility for maintaining their roofs and replacing them when necessary.

3. Pre-Existing Conditions

If an old roof already has visible signs of damage, leaks, or missing shingles before the insurance policy is issued, the insurance provider may exclude it from coverage. Insurance policies generally do not cover pre-existing conditions present before the policy was in effect.

4. Preventable Damage

Insurance policies are designed to cover sudden and accidental damage, not damage that could have been prevented through proper maintenance and care. If an old roof leaks or fails due to lack of maintenance or neglect, the insurance company may deny coverage, as they consider this damage preventable.

5. Cost-Effectiveness

Replacing an old roof can be expensive, and insurance companies may deem denying coverage more cost-effective than paying for a full roof replacement. In some cases, they may offer a depreciated or reduced payout instead of covering the entire cost of a new roof.

6. Policy Limitations

Some insurance policies have specific exclusions or limitations for roof coverage based on factors such as the age of the roof, the type of roofing material used, the different parts of a roof or other criteria. Homeowners need to read and understand the policy details to know what is covered and what is not regarding their roofs.

Assessing Insurance Coverage For A Roof In Different Scenarios

When determining coverage for a 20-year-old roof, various factors influence the outcome:

- Roof Replacement or Repair: Insurance may cover the costs of replacing an aging roof if significant damage occurs from a covered peril, such as a fallen tree during a storm. However, homeowners might be responsible for covering the depreciation of the roof’s age.

- Normal Wear and Tear: Insurance doesn’t cover damage from normal wear and tear or age-related deterioration. If your roof reaches the end of its lifespan and shows signs of aging, insurance is unlikely to cover replacement.

- Preventive Maintenance: Proactive maintenance increases the likelihood of receiving insurance coverage for damage caused by covered perils, like storms. Regular inspections and repairs demonstrate responsible homeownership, potentially enhancing insurance coverage.

- Storm Damage: Homeowner’s insurance typically covers damage caused by severe storms, such as high winds or hail. Insurance will likely assist with repair or replacement costs if a storm damages your aging roof.

Steps to Assess Your Insurance Coverage For Your Roof

1. Understand Your Policy:

Begin by thoroughly examining your homeowner’s insurance policy to grasp its coverage, which typically includes natural disasters and accidents but not wear and tear. Maintain accurate records, including maintenance invoices and repair estimates.

2. Verify Roof Age:

Insurance companies factor in your roof’s age when processing claims. A roof under 10 years old is generally considered new, while regular maintenance and recent inspections may bolster your claim’s validity.

3. Evaluate Roof Condition:

Having a well-maintained roof before damage occurs enhances claim success. Severe damage necessitating a new roof could improve the chances of full coverage.

4. Document Damage:

If it’s safe, capture images or videos of the damage, as this visual evidence can support your claim.

5. Inform Your Insurer:

Promptly notify your insurance company of the damage, providing them with documentation and repair estimates.

6. Engage a Professional Roofing Company:

Seek assistance from a reputable roofing company for a comprehensive damage report and repair/replacement estimate. They can also guide you through the insurance claim process.

7. Await Approval:

Your insurer will review your claim, possibly sending an adjuster for an inspection. Upon approval, you can hire a contractor and settle payment with the claims check.

8. Maintain Records:

Keep records of all communications regarding your insurance claim to facilitate fair compensation and ensure a smooth process.

How Do Roofing Materials Affect Your Insurance Premium?

Here’s a brief breakdown of how different roofing materials may affect your insurance premium.

- Asphalt Shingles: Affordable and versatile, asphalt shingles come in various styles and colors. However, their shorter lifespan compared to other materials may lead to higher insurance rates due to the need for more frequent repairs or replacements.

- Concrete/Clay Tiles: Offering excellent resistance to fire, insects, and rot, concrete and clay tiles are durable but come with higher costs and installation requirements. This may impact insurance rates to reflect potential expenses for repairs or replacements.

- Metal Roofs: Metal roofs are durable, long-lasting, and resistant to fire, hail, and windstorms. Due to their lower risk of damage, insurance companies may offer discounts for metal roofing, potentially leading to lower insurance rates.

- Wood Shingles/Shakes: While providing a natural look, wood shingles and shakes require more maintenance and are prone to fire damage. This risk can result in higher insurance rates to cover potential claims.

- Slate: Prized for beauty and longevity, slate roofs require minimal maintenance. However, their weight and installation costs may influence insurance rates due to the higher initial investment and specialized installation needs.

Conclusion

Navigating insurance coverage for your 20-year-old roof in Wisconsin can be tricky. You must consider factors like maintenance, regional weather patterns, and what your insurance policy covers. By understanding these things and taking proactive steps like getting regular roof check-ups, you can ensure your home stays safe from unexpected damages.

Luckily, when it comes to expert advice and professional service, Prestige Roofing is your go-to partner. With years of experience, our team offers the best roofing services to keep your roof in prime condition. From inspections to repairs and even total replacements, our skilled team will guide you through every step, ensuring your peace of mind. Don’t settle for anything less than the best, trust Prestige Roofing to safeguard your investment and keep your roof strong for years. Give us a call at (920) 791-0414.